Dealing With Mountains Of Debit And Credit

Synopsis

When struggling to deal with a mountain of debt that does not seem to be decreasing, no matter how much effort is put into curbing the spending habit, it is usually a very stressful and complicated matter. However, all is not lost as there are some exercises that can be used to bring some satiny into the debit and credit situation.

Examine It Well

The following are some areas to consider when looking into the management of debts and credit lines:

• One of the first steps to take is to face the financial situation head-on and take the time to understand in detail the situation at hand. In doing so, the individual is able to make important decisions and is definitely more aware of how to better manage the debt by considering some workable ways of decreasing it.

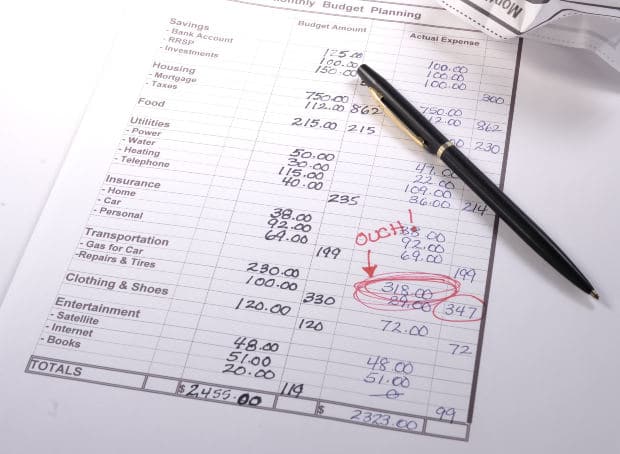

• Putting down all the incoming and outgoing financial figures on paper will help the individual make some adjustments and informed decision on which debts needs to be tacked and given priority over others. This should be decided based on the incurring interests charged on the debts, thus helping in some way not to accrue more debts.

• Contacting the creditors with the intention of redesigning the debt situation, so that it becomes more manageable will also be an option to consider. Most debtors are willing to help as it would eventually mean that they too will be able to benefit from the debt being eventually paid in full. Simply continuing with the current payment conditions will not help and may even cause more problems when the initial sum is not cleared and payments are only servicing interests incurred.

• Although this may incur some cost, seeking the help of a professional financial planner should also be explored as an option to finding ways to manage the mountain of debts. These professionals will be able to provide a better insight on how to handle matters in the best interest of the individual. read more at personal finance

Another site about personal finance

April is California’s Financial Literacy month Here’s what’s for you Sacramento Bee blog Philly.com. April is California’s Financial Literacy month Here’s what’s for you. Sacramento Bee blog No fooling April 1 is the start of California’s Financial Literacy Month it’s happening nationally too with free events workshops and online tools to help us better manage our money. It doesn’t matter what age we are or what our income is We Let your financial knowledge bloomPhilly.com. April is Financial Literacy Month Small Changes Can Help You Save More MoneyThe Savannah Reporter. all 13 news articles.…

Quicken is a personal finance management tool developed by Intuit Inc. Different and incompatible versions of Quicken run on Windows.…

Financial planner prepares financial plans for people covering various aspects of personal finance which includes cash flow management education planning.…